Getting The Paul B Insurance To Work

Wiki Article

Paul B Insurance Things To Know Before You Buy

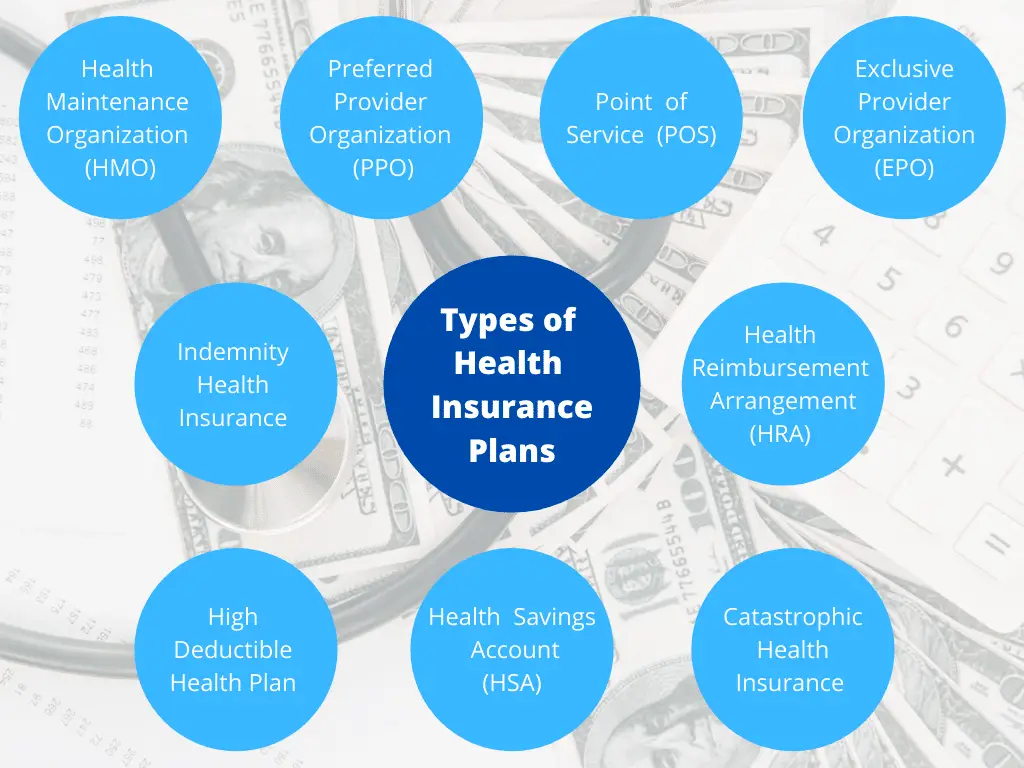

An HMO might require you to live or operate in its solution area to be qualified for coverage. HMOs frequently provide incorporated care and also concentrate on avoidance as well as health. A sort of strategy where you pay less if you make use of physicians, healthcare facilities, and various other healthcare carriers that belong to the strategy's network.

A kind of health insurance where you pay much less if you make use of carriers in the strategy's network. You can utilize physicians, medical facilities, and service providers outside of the network without a reference for an added expense.

You have options when you purchase medical insurance. If you're acquiring from your state's Industry or from an insurance coverage broker, you'll choose from wellness strategies organized by the degree of benefits they offer: bronze, silver, gold, and also platinum. Bronze plans have the least coverage, and also platinum plans have one of the most.

Any in your HMO's network. If you see a medical professional who is not in the network, you'll may need to pay the full expense yourself. Emergency situation services at an out-of-network medical facility must be covered at in-network prices, but non-participating medical professionals who treat you in the health center can bill you. This is the expense you pay each month for insurance coverage.

Facts About Paul B Insurance Revealed

A copay is a level cost, such as $15, that you pay when you obtain care. These charges vary according to your plan as well as they are counted towards your insurance deductible.

Greater out-of-pocket prices if you see out-of-network doctors vs. in-network suppliers, Even more documentation than with various other strategies if you see out-of-network providers Any in the PPO's network; you can see out-of-network physicians, however you'll pay more. This is the expense you pay monthly for insurance coverage. Some PPOs may have a deductible.

A copay is a flat fee, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the costs for treatment, as an example 20%. If your out-of-network physician bills even more than others in the area do, you may need to pay the equilibrium after your insurance policy pays its share.

This is the expense you pay each month for insurance coverage. A copay is a flat cost, such as $15, that you pay when you obtain care.

The Single Strategy To Use For Paul B Insurance

This is the cost you pay each month for insurance coverage. Your strategy may require you to pay the quantity of a deductible prior to it covers treatment beyond precautionary solutions.

We can't protect against the unexpected from occurring, yet in some cases we can secure ourselves and our families from the most awful of the financial after effects. Picking the right type as well as quantity of insurance is based on your certain situation, such as children, age, way of life, as well as work benefits. Four kinds of insurance policy that most monetary professionals advise consist of life, health, car, as well as long-lasting handicap.

It includes a death advantage and likewise a cash worth element. As the worth expands, you can access the cash by taking a financing or taking out funds and also you can finish the policy by taking the cash value of the plan. Term life covers you for a collection quantity of time like 10, 20, or three decades as well as your costs stay steady.

2% of the American populace lacked insurance protection in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Wellness Stats. Even more than 60% got their insurance coverage through a company or in the personal insurance policy market while the rest were covered by government-subsidized programs including Medicare and also Medicaid, professionals' benefits programs, and also the government industry established under the Affordable Care Act.

Paul B Insurance Can Be Fun For Everyone

Investopedia/ Jake Shi Long-term disability insurance policy supports those who come to be not able to function. According to the Social Safety and security Management, one in four employees entering the workforce will come to be disabled before they get to the age of retirement. While health and wellness insurance pays for hospitalization as well as clinical bills, you are commonly burdened with all of the costs that your income had covered.

This would be the most effective alternative for safeguarding helpful site economical disability insurance coverage. If your employer does not offer lasting coverage, here are some things to take into consideration prior to buying insurance on your very own: A plan that guarantees revenue substitute is optimum. Many policies pay 40% to 70% of your earnings. The cost of disability insurance policy is based on lots of elements, consisting of age, way of life, and also health.

Practically all states require motorists to have why not check hereRead Full Report auto insurance as well as the couple of that don't still hold motorists monetarily accountable for any kind of damage or injuries they trigger. Here are your choices when acquiring automobile insurance coverage: Responsibility coverage: Pays for home damages and also injuries you create to others if you're at fault for an accident and likewise covers lawsuits prices and also judgments or negotiations if you're taken legal action against due to a car mishap.

Company insurance coverage is often the most effective choice, yet if that is inaccessible, get quotes from several suppliers as several offer price cuts if you purchase greater than one sort of insurance coverage.

Rumored Buzz on Paul B Insurance

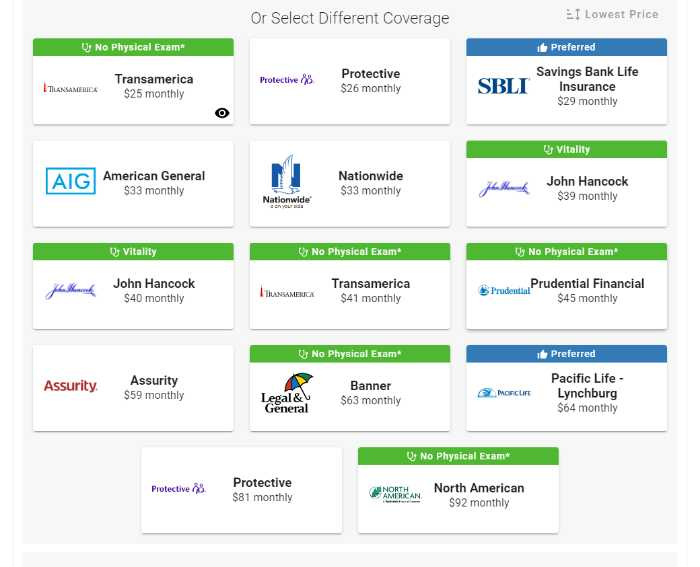

When contrasting plans, there are a few variables you'll desire to take right into factor to consider: network, price and also advantages. Take a look at each plan's network and determine if your preferred suppliers are in-network. If your medical professional is not in-network with a strategy you are taking into consideration however you intend to continue to see them, you might desire to take into consideration a various plan.

Try to locate the one that has the most advantages and also any type of particular doctors you require. The majority of companies have open registration in the autumn of every year. Open up enrollment is when you can change your benefit choices. You can alter health strategies if your company provides more than one plan.

You will certainly need to pay the premiums on your own. ; it may set you back much less than individual health and wellness insurance policy, which is insurance that you purchase on your very own, and also the advantages may be better. If you certify for Federal COBRA or Cal-COBRA, you can not be denied protection as a result of a clinical condition.

Obtain a letter from your health insurance that says how long you were guaranteed. This is called a Certification of Creditable Insurance Coverage. You might require this letter when you obtain a new group health insurance or request a private health insurance plan. Private health insurance are plans you acquire by yourself, for on your own or for your household.

The Only Guide to Paul B Insurance

Some HMOs offer a POS plan. If your company refers you beyond the HMO network, your expenses are covered. If you refer on your own outside of the HMO network, your protection might be denied or coinsurance needed. Fee-for-Service plans are commonly considered conventional strategies. You can acquire the strategy, and after that you can see any kind of medical professional at any facility.

Report this wiki page